ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile

THE VALUE ADDED TAX (VAT) GAP ANALYSIS: CASE STUDY OF UZBEKISTAN – тема научной статьи по энергетике и рациональному природопользованию читайте бесплатно текст научно-исследовательской работы в электронной библиотеке КиберЛенинка

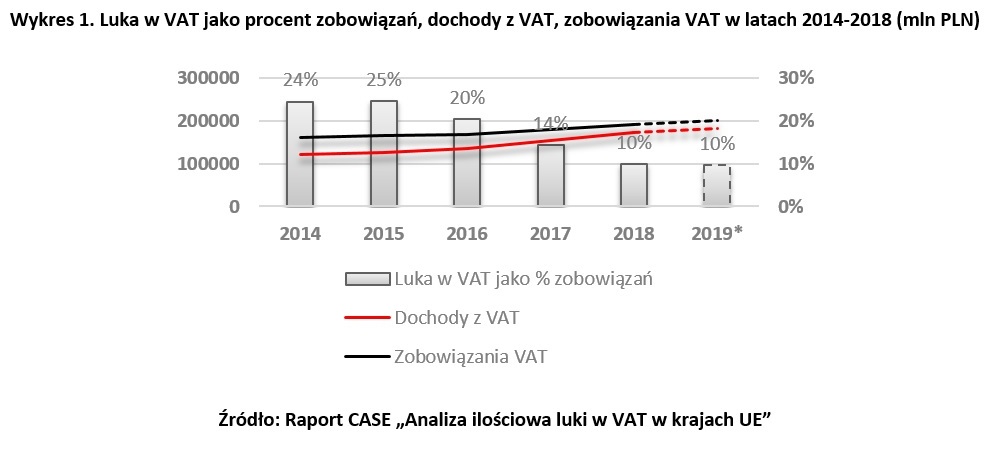

Luka w VAT w Polsce może wzrosnąć do 14,5% w 2020 r. - CASE - Center for Social and Economic Research