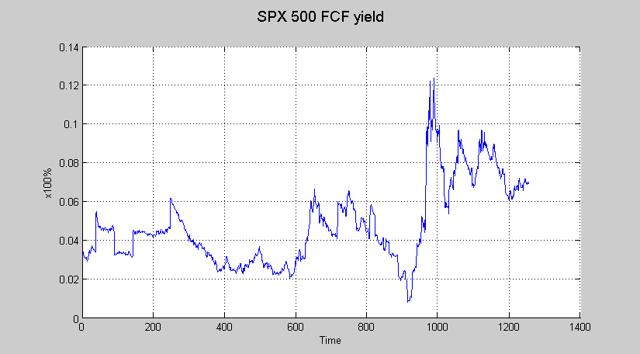

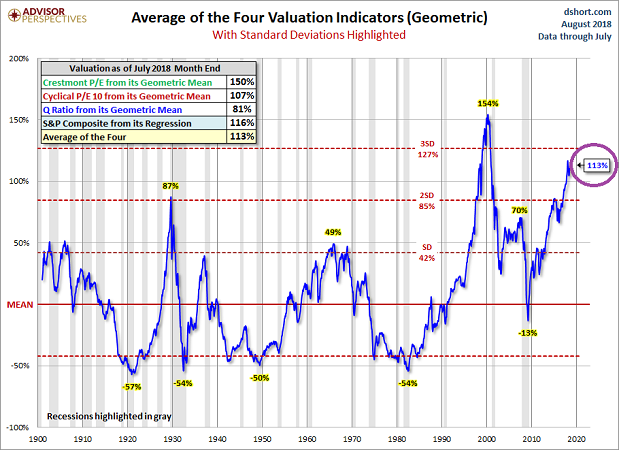

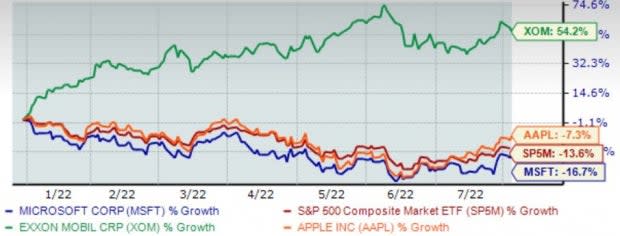

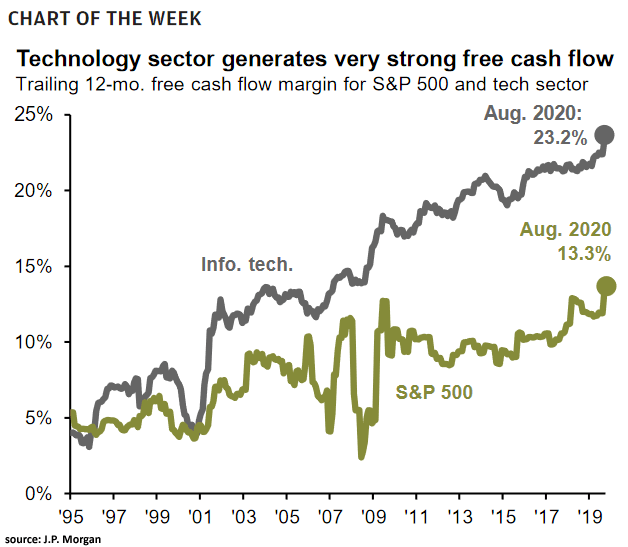

A Quick Look At The S&P500 Free Cash Flow. As Long As The Real Economy Remains On-Track, Expect Healthy Corrections, Not Protracted Bear Markets. | Seeking Alpha

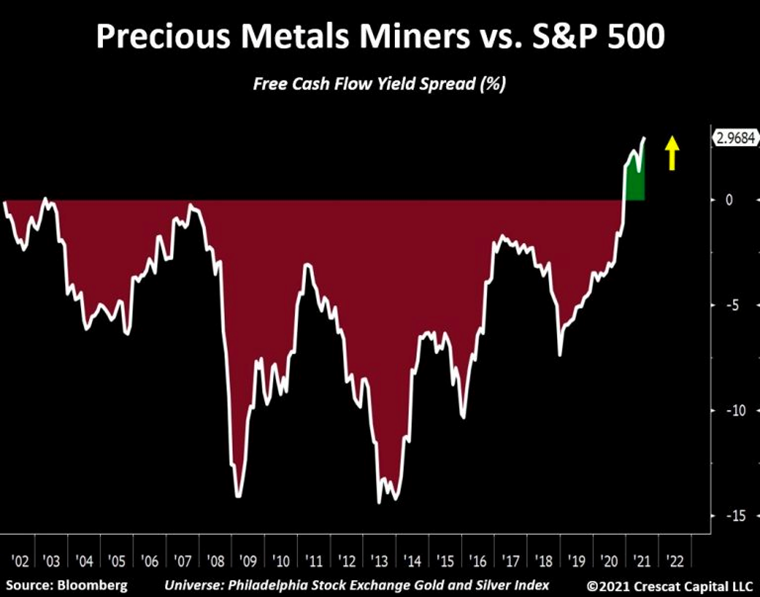

Otavio (Tavi) Costa on X: "Back to fundamentals: Gold and silver miners have never looked this cheap relative to the S&P 500. Their free-cash-flow yield is almost twice the overall market. The

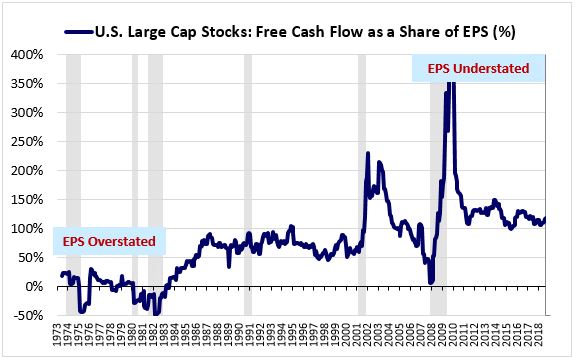

The Earnings Mirage: Why Corporate Profits are Overstated and What It Means for Investors | O'Shaughnessy Asset Management

:max_bytes(150000):strip_icc()/price-to-cash-flowratio-FINAL-d1610a07bd744134941b6e6736c8e4ca.png)